Some Known Incorrect Statements About Wyhy

Some Known Incorrect Statements About Wyhy

Blog Article

Wyhy Things To Know Before You Buy

Table of ContentsWhat Does Wyhy Do?3 Simple Techniques For WyhySome Known Details About Wyhy Indicators on Wyhy You Should KnowWyhy - QuestionsWhat Does Wyhy Do?

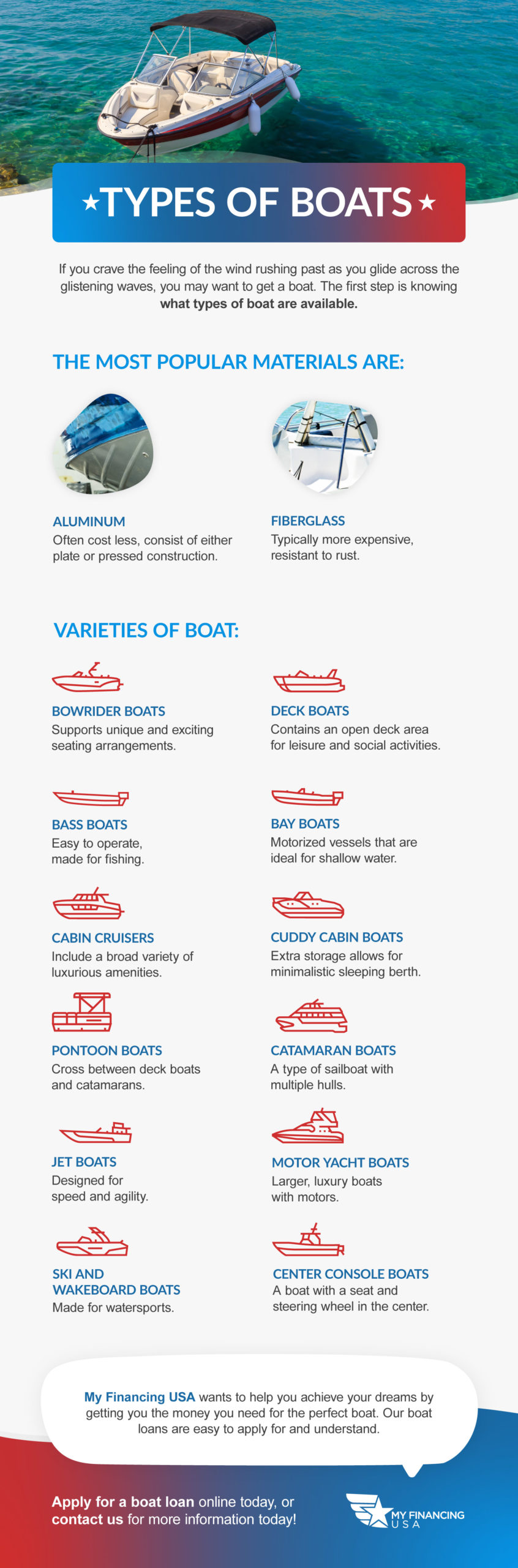

They'll desire to see that the price you're paying is a realistic valuation of the boat; new boats will usually offer fewer concerns for a loan provider than a made use of watercraft that may be priced past what the marketplace may birth. If there is a concern concerning the value of a made use of watercraft and you're willing to take down sufficient cash to reduce the loan provider's danger, that issue may be sufficiently dealt with.When determining where to obtain your boat funding, 2 major options are banks and cooperative credit union. There are plenty of advantages when you pick to finance the boat at a lending institution, which is a not-for-profit monetary cooperative that's been created to profit its participants and boost their monetary health.

Wyhy - An Overview

To obtain a watercraft car loan with SCCU, you just require to stay in Florida and register your boat in the state of Florida. See our five-minute guide to acquiring a boat.interest pricesfor watercraft car loans are usually lower than those at a bankfees are commonly loweras a participant, you: frequently receiver far better rate of interest for car loans will obtain extra personalized service, which can include financial educationhave the opportunity to sustain your communitywill normally get a higher rates of interest on cost savings accounts, certificates, and a lot more, making a cooperative credit union membership a win/winSCCU offers greater than 500,000 members in these counties along the east coastline of Florida with 60+ branch places from Flagler to Miami-Dade areas.

The digital closing process is rapid and basic (or you can shut at the branch nearby you), and we also use free Online and Mobile Financial for the utmost in benefit. If you have inquiries, just call the branch nearest you:321 -752 -2222954 -704 -5000305 -882 -5000800 -447 -7228 We have affordable financing programs for the boat of your dreams!.

The 6-Minute Rule for Wyhy

After that, estimate just how much a monthly boat loan repayment will certainly cost and identify if you can afford it. We make this simple with our Watercraft Lending Calculator tool. Once you have actually established the specific version you wish to acquire and know the purchase price, you'll have to choose a loan provider. There are lots of excellent alternatives for watercraft funding suppliers, yet doing your study initially is crucial.

Wyhy Things To Know Before You Get This

If it's 700 or above, that box is a cinch to examine. If it's in the top 600 array, you shouldn't have a trouble getting funding, but you may get billed extra on the rates of interest. Scores reduced than that can come to be problematic, so examine your credit scores rating initially. When it comes to the other elements, you may need to provide some information (such as a personal financial statement or employment verification).

Financing can help you preserve liquidity, however much more significantly, it may additionally assist you purchase a more expensive boat that might otherwise appear unreachable - wyoming credit unions. Watercraft finances made use of to be extra minimal in period, today common boat funding regards to 10 to 20 years are standard. Rate of interest are extremely low, and the deposits needed these days can range anywhere from no money down to 20 percent

This overview covers exactly how to protect financing for a boat, no matter of your credit report circumstance or the boat you choose to acquire. If you have financial savings, you might be questioning if you must bother financing a watercraft or if you can locate a more affordable choice to buy with money. While you may not need to bother with handling a financing or making month-to-month repayments, there aren't numerous benefits to getting a boat in cash money over securing a loan.

The Only Guide to Wyhy

For numerous boat buyers, a big, lump-sum purchase isn't possible. investigate this site You could have some savings for a down payment, you may desire to get a financing to cover the staying price.

At My Funding USA, we provide better-than-average watercraft financing. Our rates of interest for boat loans are Rates In between 6.49% and 19.95% relying on your area, credit score history, kind of watercraft you are financing and the amount you are financing. Utilize our watercraft car loan repayment calculator to determine what monthly repayment you may have the ability to afford.

6 Easy Facts About Wyhy Described

Nonetheless, this influence is normally small and temporary. Connect to a professional credit scores specialist with any type of concerns or concerns. The rates and terms you might have the ability to get vary from lender to lending institution. Compare the lenders by discussing your alternatives with them and carefully reviewing the small print, which will have details on the financing's size, what minimum credit history you ought to have and whether there are constraints on your watercraft's age.

Rate of interest are a vital factor to consider, as they can significantly impact just how much you pay overall over the financing period. The lower the rates of interest, the better. Nonetheless, it is important to guarantee you are comparing passion rates for the exact same lending kinds. Commonly, lenders provide the most affordable prices for the fastest terms, which might not be the ideal economic option for you - https://fliphtml5.com/homepage/earpm/johncole2312/.

Report this page